There are many newbies who don’t know about the difference between a coin and a token. We have come to clear those terms and provided in-depth information.

Let’s start with the coin, Have you heard about Bitcoin? If yes. Then, it is one of the most popular coins in cryptocurrency, and it is basically called digital money. User need their own blockchain network to access the coins, and they send or receive the coins for only those who are accepting cryptocurrency.

On the other side, we talk about tokens, it is mainly known as a digital asset. It does not have its own blockchain; these tokens are accessed in the existing blockchain network. Ethereum is one of the best platforms for creating tokens easily, for example, the ERC-20 token.

Hang on with us, let’s explore the coin vs token blockchain and provide some useful details about both terms.

What Is Coin?

A coin is a digital asset or type of currency that runs on its own blockchain. Unlike tokens, which are built on existing blockchains, coins are unique to their respective networks. Examples include Bitcoin (BTC), Ethereum (ETH), and Litecoin.

These coins can be used for a variety of purposes, including transferring value, purchasing products and services, and storing money. They use cryptography techniques to maintain security and avoid fraud. An app like Coinbase will provide decentralized, transparent, and secure alternatives to established financial systems.

Basic Functionality:

- Most cryptocurrency coins run on decentralized networks, which means they are not controlled by a central authority such as a government or bank.

- Coins use strong cryptography to secure transactions and prevent fraud, hence preserving network integrity.

- Many coins, such as Bitcoin, have a set or limited quantity, which can assist in preventing inflation while increasing scarcity over time.

- Coin transactions are recorded on a public ledger (blockchain), ensuring openness and traceability.

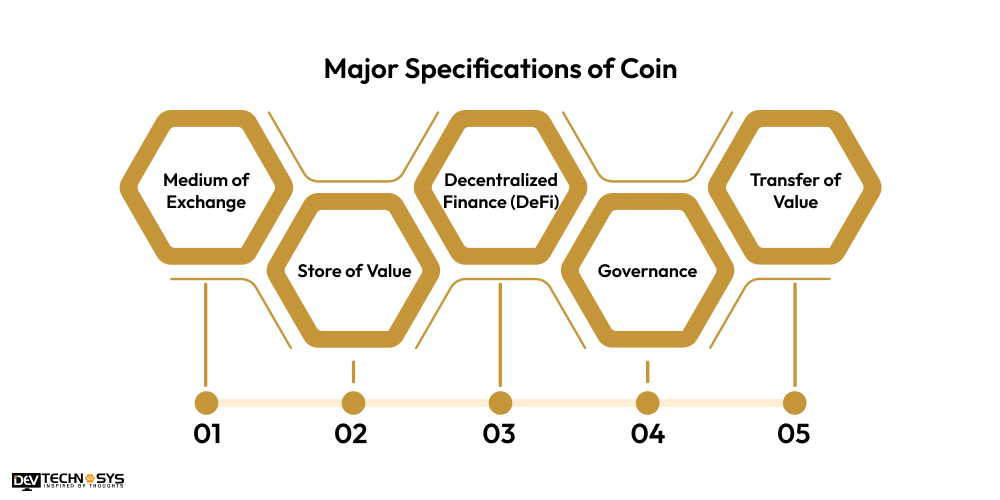

Major Specifications of Coin

Coins in cryptocurrency are used for a wide range of functions. They function as a means of exchange, letting users conduct transactions and pay for products and services. Bitcoin and Litecoin, for example, can be used as both storage and investment assets.

Furthermore, cryptocurrency such as Ethereum is utilized to power decentralized applications (DApps) and smart contracts. An app like kucoin plays an important role in securing and validating transactions within their own blockchain networks, which promotes decentralization and transparency.

- Medium of Exchange: Used to purchase goods and services.

- Store of Value: Used for long-term investment or savings (e.g., Bitcoin).

- Transaction Fees: Used to pay network transaction fees, particularly on platforms like as Ethereum.

- Decentralized Finance (DeFi): This term refers to lending, borrowing, and staking on DeFi systems.

- Governance: Some networks utilize currencies to vote on protocol upgrades or modifications.

- Transfer of Value: A method of quickly and securely sending money across borders.

Interested in a chatbot demo, pricing, or more info? Fill out the form our expert will contact you shortly.

Chatbot Demo

Cost to Develop an app

Industry Report

Case Study

Token Vs Coin: 7 Popular Coins

These seven coins have a wide range of applications, from store of value and payment solutions to decentralized applications and smart contracts. Here are 7 popular cryptocurrencies, each with its own distinct features and applications:

- Bitcoin(BTC)

- Ethereum(ETH)

- Binance Coin (BNB)

- Cardano(ADA)

- Ripple(XRP)

- Solana(SOL)

- Litecoin(LTC)

1. Bitcoin (BTC)

Bitcoin is the first and most well-known cryptocurrency, sometimes referred to as “digital gold.” Bitcoin, created in 2009 by an unnamed individual or group known as Satoshi Nakamoto, runs on a decentralized network powered by blockchain technology.

It is largely used as a store of value and is the most popular cryptocurrency for transactions, investments, and remittances. Bitcoin’s 21 million coin supply makes it an appealing inflation hedge.

2. Ethereum(ETH)

Ethereum, founded by Vitalik Buterin in 2015, is the second-largest cryptocurrency by market capitalization. Ethereum, unlike Bitcoin, is more than simply a money; it is a platform that allows developers to create decentralized apps (dApps) and smart contracts, allowing them to build complicated blockchain-based solutions.

Ethereum development company has the ability to upgrade the Ethereum 2.0 seeks to enhance scalability and energy efficiency, positioning it as a prominent player in decentralized finance.

3. Binance Coin (BNB)

Binance Coin was initially introduced as a utility token for the Binance exchange, providing discounts on trading expenses. Over time, its applications have grown to include decentralized finance (DeFi) platforms, token sales on Binance Launchpad, and transaction fees on Binance Smart Chain (BSC).

BNB’s utility in various facets of the Binance ecosystem has helped it gain popularity. For a successful BNB coin, you can consult with an binance app development company to deliver high-performing coin with unique functionalities.

4. Cardano(ADA)

Cardano, a blockchain technology created by Ethereum co-founder Charles Hoskinson, is intended for secure and scalable applications. Cardano distinguishes itself through a research-driven development process, a focus on sustainability, peer-reviewed protocols, and a proof-of-stake consensus mechanism.

Cardano blockchain development company provides more energy-efficient alternatives to current blockchains while also allowing smart contracts, DApps, and tokens.

5. Ripple(XRP)

Ripple’s XRP Ledger seeks to provide quick, low-cost cross-border payments. XRP is intended to serve as a bridge currency for financial institutions, and it has been embraced by banks and payment providers globally.

Ripple’s primary purpose is to improve the speed and efficiency of worldwide money transactions, and its network is renowned for its cheap transaction costs and scalability.

6. Solana(SOL)

Solana is a high-performance blockchain renowned for its speed and low transaction fees. Its revolutionary Proof of History (PoH) consensus mechanism enables it to perform thousands of transactions per second (TPS), ranking it among the quickest blockchains on the market.

Solana blockchain development services provider can complete the requirements, such as DeFi projects, NFT makers, and developers seeking scalability.

7. Litecoin(LTC)

Litecoin, founded in 2011 by Charlie Lee, is a peer-to-peer cryptocurrency that aims to provide faster transaction times and lower fees than Bitcoin. It runs on a comparable blockchain technology and employs the Scrypt hashing algorithm, which is less computationally costly than Bitcoin’s SHA-256. Litecoin has established a reputation as the “silver” to Bitcoin’s “gold,” yet it is still one of the most popular and trusted cryptocurrencies.

What Is Token?

A token is a sort of cryptocurrency symbolizing an asset or service on a specific platform; however, unlike coins, tokens are constructed on blockchains such as Ethereum or Binance Smart Chain.

Tokens can be used for a variety of purposes, including allowing access to a decentralized application (DApp), voting rights in governance decisions, and reflecting real-world assets (such as real estate or art).

There are two types: utility tokens, which are used to provide specialized services on a platform, and security tokens, which indicate asset tokenization ownership. Tokens are adaptable and can be readily transferred and traded across many exchanges.

Basic Functionality:

- Tokens, unlike coins, are created on pre-existing blockchains (such as Ethereum or the Binance Smart Chain) and use smart contracts for functionality.

- Tokens frequently grant access to a platform’s services or applications, allowing users to execute certain acts such as staking, governance voting, or accessing features.

- NFTs (non-fungible tokens), security tokens, and payment tokens are examples of tokens that can represent assets, rights, or services respectively.

- Tokens are easily traded on exchanges and transferred between platforms, making them adaptable in the cryptocurrency ecosystem.

Major Specifications of Token

Tokens in cryptocurrency are used for a variety of purposes. They might represent asset ownership, such as real estate or digital art (NFTs), or they can be used as utility tokens to get access to platform services, such as transaction fees or governance participation.

With the help of security token offerings development companies, tokens can reflect the ownership of real-world assets or financial instruments. Tokens can also be used to stake, reward users, and incentivize network membership, providing a wide range of services inside the blockchain ecosystem.

- Access to Services: Tokens provide access to specific features or services on a platform or decentralized application (DApp).

- Governance: Governance token holders are able to vote on platform decisions and protocol modifications.

- Transaction Fees: Certain tokens are used to pay transaction fees on a blockchain network.

- Representation of Assets: Tokens can represent ownership or rights to real-world assets such as real estate or intellectual property.

- Staking and Rewards: Tokens can be staked to obtain prizes or to contribute to network security and consensus.

- Incentivization: Tokens are frequently used to incentivize users for contributing to a platform or ecosystem.

Coin Vs Token: 7 Popular Tokens

These seven tokens represent the diversity of the cryptocurrency ecosystem, ranging from stablecoins like USDT and USDC to governance tokens like UNI and AAVE, as well as developing sectors such as virtual reality and DeFi. Each plays an important role in improving decentralized money, governance, and blockchain technology.

- UniSWAP (UNI)

- Chainlink (LINK)

- Tether(USDT)

- USDCoin (USDC)

- Decentraland (MANA)

- Aave(AAVE)

- Shiba Inu(SHIB)

1. UniSWAP (UNI)

Uniswap is an Ethereum-based decentralized exchange (DEX) that allows users to swap ERC-20 tokens without relying on a central authority. UNI is the Uniswap platform’s governance token, allowing token holders to participate in decision-making processes related to protocol upgrades, fee structures, and other significant changes.

UNI is critical for encouraging liquidity suppliers and customers in the Uniswap ecosystem, as well as playing an important role in the Decentralized finance movement.

2. Chainlink (LINK)

Chainlink is a decentralized oracle network that allows smart contracts to safely communicate with real-world data, APIs, and payment systems. LINK tokens are used to pay for data services on the Chainlink network while also incentivizing node operators to provide accurate and trustworthy data.

Chainlink is essential for decentralized apps (DApps) that require off-chain data, and it plays an important role in industries such as insurance, supply chain management and banking.

3. Tether(USDT)

Tether (USDT) is a stablecoin tied to the value of the US dollar, designed to give stability in the unpredictable cryptocurrency market. It is extensively utilized for trading and protecting value during periods of extreme market volatility.

Traders and investors utilize USDT to transfer funds between exchanges without having to convert back into fiat currency. As we discussed earlier with crypto token development company, tether is one of the most actively traded coins, and it is widely utilized in lending and DeFi apps.

4. USDCoin (USDC)

USD Coin (USDC), like Tether, is a stablecoin linked to the US dollar. USDC, created by Circle and Coinbase, is used for trading, lending, and participating in DeFi platforms.

It is well-known for having completely backed reserves and being audited on a regular basis, providing transparency and reliability. USDC is widely accepted on several exchanges and DeFi protocols, providing users with reliability in the cryptocurrency ecosystem.

5. Decentraland (MANA)

Decentraland (MANA) is the native token for Decentraland, a virtual reality (VR) platform based on the Ethereum blockchain. MANA is used to purchase virtual land, products, and services in the Decentraland metaverse.

Consult with a token development company; users can develop, purchase, and sell digital assets, making it an attractive option for producers, gamers, and investors interested in virtual worlds.

6. Aave(AAVE)

Aave is a decentralized lending and borrowing network built on the Ethereum blockchain. The AAVE coin has multiple purposes in the ecosystem, including governance and staking.

Staking AAVE tokens allow holders to participate in protocol decisions, vote on crucial improvements, and earn incentives. Aave, which allows users to earn interest on their crypto holdings and borrow assets in a decentralized, permissionless manner, has become one of the most popular DeFi protocols.

7. Shiba Inu(SHIB)

Shiba Inu (SHIB) is an Ethereum-based token that began as a meme coin but has grown rapidly owing to its community-driven nature. SHIB, often known as the “Dogecoin killer,” has a sizable and active user base and is utilized for trading, staking, and decentralized governance.

According to the dApps development company, SHIB has evolved into a number of initiatives, including a decentralized exchange (ShibaSwap) and an NFT platform.

Coin Vs Token: Major Differences

Coins and tokens are both important components of the cryptocurrency ecosystem, but they differ significantly in their use cases, generation procedures, and technical architecture. Here’s a full comparison of coins vs tokens in Blockchain, showing the key differences:

Features |

Coin |

Token |

| Definition | Coins are digital currencies that run on their own blockchain. | A token is a digital asset created on an existing blockchain using smart contracts. |

| Blockchain | Coins run on their own blockchain (e.g., Bitcoin and Ethereum). | Tokens are constructed on top of existing blockchains such as Ethereum, Binance Smart Chain, and Solana. |

| Use Case | Primarily used as a medium of commerce, a store of value, or to secure networks (for example, Bitcoin). | Used for a multitude of reasons, including accessing decentralized applications (DApps), representing assets, and facilitating smart contract on blockchain. |

| Examples | Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Bitcoin Cash (BCH). | Uniswap (UNI), Chainlink (LINK), Tether (USDT), Decentraland (MANA), Aave (AAVE). |

| Ownership | Coin ownership usually indicates value or the ability to safeguard the network (for example, by mining or staking). | Token ownership frequently indicates access to a service or asset on a particular platform (for example, staking rewards and governance rights). |

| Transaction Fees | Coins such as Bitcoin and Ethereum are frequently used to pay transaction fees within their respective networks. | Tokens generally incur gas fees on the host blockchain (for example, Ethereum’s gas fees for ERC-20 tokens). |

| Transaction Speed | Coin transactions may be slower depending on the network’s consensus method (e.g., Bitcoin’s Proof of Work). | Token transaction speed is determined by the performance of the underlying blockchain, such as the throughput of Ethereum or the speed with which Solana processes transactions. |

| Decentralization | Coins are frequently designed to work in decentralized networks (such as Bitcoin’s fully decentralized network). | Tokens can be decentralized, but their governance may differ depending on the platform they are constructed on. |

| Mining/Creation | Coins are often mined or staked on their native blockchain (such as Bitcoin mining). | Tokens are produced using a method known as an Initial Coin Offering (ICO), an Initial DEX Offering (IDO), or smart contracts. |

| Market Trading | Coins are often exchanged on most cryptocurrency exchanges. | Tokens can also be traded, albeit the available exchanges may be platform-specific (for example, Uniswap for ERC-20 tokens). |

| Security | Coins are often protected by Proof of Work (PoW) or Proof of Stake (PoS) procedures on its blockchain. | Tokens inherit the security of the blockchain on which they are designed (for example, ERC-20 tokens are secured by the Ethereum network). |

| Value Stability | Coins such as Bitcoin are frequently viewed as a store of value or an asset that increases in value over time. | Tokens might be more volatile based on the project’s utility and popularity on its platform. Some tokens are stablecoins (such as USDT or USDC) that are tied to fiat currency. |

| Regulation | Coins are often subject to governmental control, particularly in nations that recognize them as currency or assets (such as Bitcoin). | Tokens are more likely to come under different regulatory regimes depending on whether they are classified as securities, utility tokens, or other classifications. |

| Interoperability | Coins are primarily intended for use on their own blockchain and network. | Tokens can be utilized on many platforms depending on the blockchain they are constructed on (for example, ERC-20 tokens can be used in the Ethereum ecosystem). |

| Development Focus | Coin development frequently focuses on network security, scalability, and decentralization (for example, Bitcoin and Ethereum). | Token development focuses on delivering certain features, services, or governance for the platform they represent (for example, staking and voting). |

Coin Vs Token: Conclusion

Now, the time has come to say goodbye. We are happy to provide you with detailed information about crypto coin vs token crypto and their basic functionalities.

We hope that this has cleared up all your confusion or doubts regarding cryptocurrency token vs coin and which is better in terms of functionality and implementation. We also offer the best existing tokens and coins and explain why they are used.

If you want to know more about the difference between crypto token vs coin crypto, you can visit the Ethereum token development company for detailed information and efficient development solutions.

Frequently Asked Questions

1. What Is The Main Difference between Token Vs Coin?

The primary distinction is that tokens are constructed on top of other blockchains, such as Ethereum’s blockchain, whereas coins have their own blockchain (for example, Bitcoin uses the Bitcoin blockchain).

2. How Do Identify A Coin And Token?

To determine a coin’s identity, see if it uses its own blockchain (e.g., Ethereum, Bitcoin). Make that a token (such as Uniswap or Chainlink) is present on an existing blockchain and that it usually represents assets or particular functionalities.

3. Can A Token Become A Coin?

It is possible for a token to turn into a coin if it chooses to create its own blockchain. This entails setting up a new network and moving the token’s functions to its blockchain.

4. Are Coins or Tokens Easier To Create?

Since creating a new blockchain is not necessary, token creation is simpler. They can be made on already-existing blockchains, such as Ethereum, which provides token specifications (such as ERC-20).

5. Is Doge A Coin Or Token?

Dogecoin is a cryptocurrency coin. It functions on the Dogecoin blockchain, which is distinct from other networks that normally house tokens, such as Ethereum or Binance Smart Chain.